Title loan payment schedules detail how borrowers repay car loans over fixed periods, with lenders assessing vehicle value and borrower ability to set terms. Understanding these schedules is vital for debt management or liquidity, but late payments incur penalties. Borrowers often prefer making payments early in the month after receiving salaries to stay on top of obligations and maintain positive credit profiles. Effective management includes aligning payments with income cycles, refinancing if interest rates drop, using direct deposit, and adjusting plans based on changing financial circumstances to ensure timely repayment and avoid delays or penalties.

Understanding how income timing influences title loan payment schedules is crucial for both lenders and borrowers. This article delves into the intricate relationship between financial timelines and loan repayment strategies, offering a comprehensive overview of title loan payment schedules. We explore how income variability affects borrowing options and present actionable tips to effectively manage these plans. By optimizing title loan payment schemes, individuals can navigate their financial obligations with greater confidence.

- Understanding Title Loan Payment Schedules: A Comprehensive Overview

- The Role of Income Timing in Shaping Loan Repayment Strategies

- Effective Management: Tips for Optimizing Title Loan Payment Plans

Understanding Title Loan Payment Schedules: A Comprehensive Overview

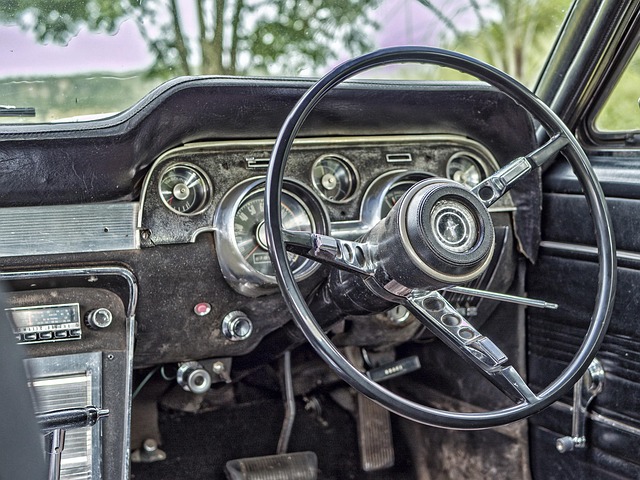

Title loan payment schedules are a crucial aspect of understanding car title loans. These schedules dictate how and when borrowers will repay their loans, which typically involve making regular payments over a fixed period. The process starts with an application where lenders assess various factors, including the value of the vehicle, its condition, and the borrower’s ability to repay. Based on these factors, loan requirements are determined, setting the stage for the payment schedule.

Once approved, borrowers receive their funds, often within a short timeframe. Subsequently, they must adhere to the agreed-upon repayment plan, which typically includes monthly installments. For those considering debt consolidation or seeking liquidity due to unforeseen circumstances, understanding these schedules is paramount. Car title loans, with their structured payment plans, can offer a viable solution for immediate financial needs, but borrowers must be prepared to meet the loan requirements and stick to the scheduled repayments to avoid potential penalties.

The Role of Income Timing in Shaping Loan Repayment Strategies

The timing of income plays a pivotal role in shaping individuals’ strategies for repaying title loans. For many borrowers, receiving their salaries or other regular income streams at the beginning of the month allows them to allocate funds towards loan repayments early on. This proactive approach ensures that they stay on top of their financial obligations and can avoid potential penalties for late payments. It also enables them to better manage their budgets by setting aside a fixed amount each month for loan repayment, thereby reducing the burden of unexpected financial strain.

Moreover, income timing influences the overall management of secured loans like title loans, where the borrower’s vehicle equity serves as collateral. Timely income allows borrowers to make consistent payments, potentially avoiding the need to refinance or roll over the loan, which can lead to additional fees and interest charges. This is particularly important given that credit checks are often conducted during the application process for such secured loans. Maintaining timely repayments demonstrates responsible financial behavior and can help individuals build or maintain a positive credit profile over time.

Effective Management: Tips for Optimizing Title Loan Payment Plans

Effective management of your title loan payment plans is crucial to ensuring timely repayment and avoiding potential penalties or delays. One key strategy is to align your payments with your income cycles. For instance, if your income is most consistent towards the end of each month, structure your title loan payments accordingly. This ensures you can comfortably meet your financial obligations without compromising other essential expenses.

Additionally, consider options like loan refinancing to optimize your payment schedule further. If interest rates have dropped since securing your original title loan, refinancing could lower your monthly payments and overall interest costs. Utilizing direct deposit for your title loan payments is another efficient method, as it automates the process, reducing the risk of late payments due to manual transactions. Regularly reviewing and adjusting your repayment plan based on changing financial circumstances is an effective way to maintain a robust title loan payment schedule.

In understanding how title loan payment schedules function, recognizing the profound impact of income timing becomes paramount. By aligning repayment strategies with individual financial flows, borrowers can more effectively manage their title loan payment schedules. Through proactive planning and implementing the suggested optimization tips, one can streamline their loan repayments, ensuring a smoother financial journey.