Unveiling Hidden Terms in Title Loan Repayments

Understanding title loan payment schedules is crucial for borrowers. Decoding contract terms, includ…….

In today’s dynamic financial landscape, alternative lending solutions have emerged to cater to diverse borrowing needs. One such innovative approach is the title loan—a secured lending option that utilizes an individual’s asset, typically their vehicle, as collateral. This article delves into the intricate world of title loan payment schedules, exploring how these structured repayment plans are revolutionizing access to capital for many. We will navigate through various facets, from understanding the basics to examining global implications, to uncover why these payment schedules are a game-changer in personal finance.

Definition: A title loan payment schedule refers to the predetermined plan outlining how borrowers repay their loans over time. It is a crucial aspect of title lending, ensuring both borrower understanding and lender protection. This schedule breaks down the total loan amount into manageable installments, typically with specific due dates for each payment.

Key Components:

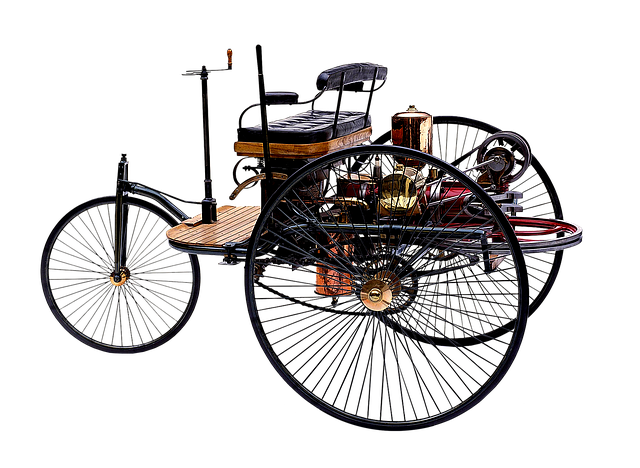

Historical Context: Title loans have a rich history dating back to ancient civilizations where collateralized lending was common. However, modern title loan payment schedules emerged as a structured solution in the 21st century with the rise of digital lending platforms. This innovative approach democratizes access to credit, catering to individuals who may not qualify for traditional bank loans.

Significance: These payment schedules are significant for several reasons:

The global influence of title loan payment schedules is a testament to their effectiveness in addressing diverse financial challenges worldwide. Here’s a glimpse into key trends:

| Region | Impact and Trends |

|---|---|

| North America | Title loans are particularly popular in the United States, where they serve as a bridge for short-term financial needs. Strict regulations in Canada have led to a more regulated market, offering borrowers enhanced protections. |

| Europe | With varying lending standards across countries, title loans fill gaps in access to credit, especially in regions with limited traditional banking services. |

| Asia Pacific | The region’s rapid economic growth has sparked an increase in title loan activity, catering to the financial demands of a tech-savvy population. |

| Africa | Title lending is emerging as a vital tool for financial inclusion, empowering individuals to access capital for education, business, or emergency expenses. |

These trends highlight the adaptability and reach of title loan payment schedules, making them a significant force in global finance.

The economic landscape plays a pivotal role in shaping the success and growth of title loan payment schedules. Here’s an analysis:

Technology has been a catalyst for the evolution of title loan payment schedules, creating a seamless and efficient lending experience:

Given the sensitive nature of title lending, robust policies and regulations are essential to protect borrowers and maintain market stability:

Despite its benefits, the title loan industry faces challenges and criticisms that require thoughtful solutions:

Proposed Solutions:

In a rural African village, a local non-profit organization partnered with a title loan provider to offer small business loans secured against individuals’ vehicle titles. This initiative aimed to support entrepreneurs who traditionally had limited access to banking services. The program’s success was remarkable:

A title loan program in a low-income urban area targeted individuals struggling with poor credit histories. The initiative offered short-term, small-dollar loans with structured repayment plans:

The title loan payment schedule market is poised for growth, driven by technological advancements and evolving consumer preferences:

Title loan payment schedules have emerged as a powerful tool for financial empowerment, offering unprecedented access to capital for millions worldwide. Through structured repayment plans, borrowers gain control over their financial obligations while lenders benefit from reduced risk and enhanced lending efficiency. As technology advances and regulations evolve, this sector is poised to play an even more significant role in shaping the global financial landscape.

Q: How do title loan payment schedules differ from traditional loan payments?

A: Traditional loans often have fixed interest rates and monthly payments, while title loan schedules vary based on the repayment period and loan amount, providing more flexibility.

Q: Can I afford a title loan?

A: Affordability depends on your income, expenses, and ability to repay. Responsible lending practices ensure borrowers understand their obligations, but it’s crucial to assess your financial situation thoroughly.

Q: What happens if I miss a payment?

A: Lenders have different policies for missed payments. Communicate with your lender promptly, as they may offer solutions like rescheduling or rearranging your payment schedule without penalties.

Q: Are title loans regulated, and how do they protect borrowers?

A: Yes, they are subject to regulatory oversight. Strict regulations ensure fair lending practices, borrower rights, and transparent terms, protecting individuals from predatory lending.

Understanding title loan payment schedules is crucial for borrowers. Decoding contract terms, includ…….

Understanding title loan payment schedules is crucial for financial clarity and avoiding unexpected…….

Late payments on title loans disrupt repayment plans, leading to higher interest rates, fees, and re…….

When considering a Houston title loan, understand the strict 30-60 day repayment term with no option…….

Title loan payment schedules vary greatly due to flexible but complex terms including variable inter…….

New regulations emphasize Title loan payment schedules for transparency, giving borrowers clear loan…….

Title loan payment structures vary between interest-only and principal-and-interest options, caterin…….

Understanding title loan payment schedules is crucial for borrowers. These schedules depend on princ…….

Many consumers in financial crises turn to title loans for quick solutions, but understanding comple…….

Title loan payment schedules offer fixed regular payments for emergency funding, aiding budgeting bu…….