Many consumers in financial crises turn to title loans for quick solutions, but understanding complex payment schedules is crucial. Lenders in cities like Fort Worth offer various terms, and transparent communication about interest rates, fees, and structures helps borrowers make informed decisions. Challenges include unexpected frequency and high payments, complex interest calculations, and hidden fees that can delay vehicle ownership during loan periods. Effective management involves consistent repayments according to agreed-upon schedules while maintaining vehicle access, demonstrating responsible borrowing and avoiding penalties.

Title loan payment schedules top consumer concerns, with many borrowers facing challenges navigating these complex financial tools. This article delves into the core issues surrounding title loan payments, exploring common pain points and offering effective strategies for management. Understanding these concerns is crucial for both lenders and borrowers to foster fair practices and ensure positive outcomes in the title loan landscape.

- Understanding Title Loan Payment Concerns

- Common Pain Points in Title Loan Schedules

- Strategies for Effective Title Loan Management

Understanding Title Loan Payment Concerns

Many consumers seeking emergency funds often turn to title loans as a quick solution during financial crises. However, one of the primary concerns surrounding this type of loan is the intricate title loan payment schedules. Lenders in cities like Fort Worth offer various repayment plans, but understanding these structures is essential for borrowers.

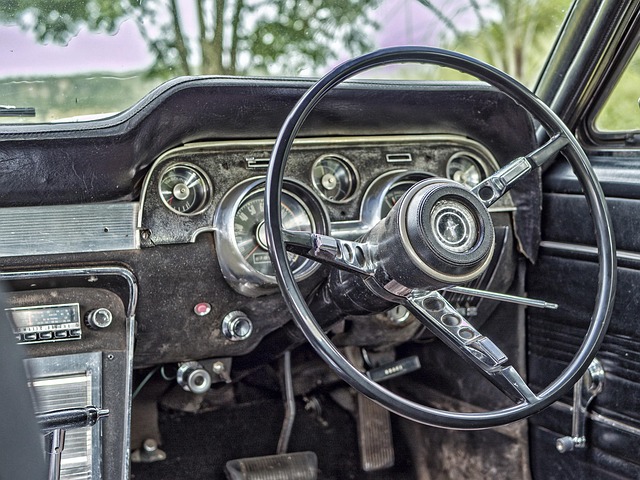

The complexity arises from the fact that these loans are secured against a person’s vehicle title, and repayment terms can vary widely. Borrowers must carefully consider their financial capabilities to meet these obligations without defaulting. A transparent title loan process with clear communication about interest rates, fees, and payment schedules is crucial in ensuring consumers make informed decisions.

Common Pain Points in Title Loan Schedules

When it comes to title loan payment schedules, several common pain points often concern borrowers. One major issue is the unexpected nature of these schedules, which can catch folks off guard with their frequent and sometimes hefty payments. This is particularly problematic for those relying on emergency funding to cover unforeseen expenses. The complexity of the schedule, involving intricate details about interest rates, fees, and repayment terms, can be overwhelming for borrowers who lack financial acumen or are unfamiliar with such loans.

Moreover, the title transfer process itself can introduce delays and complications. Borrowing against a car title means relinquishing ownership temporarily, which is a significant step for many individuals. They may face challenges in understanding how this affects their daily commutes or access to transportation during the loan period. Additionally, borrowers should be vigilant about potential hidden fees and charges that could significantly impact the overall cost of their car title loans, adding further stress to an already delicate financial situation.

Strategies for Effective Title Loan Management

Managing a title loan effectively requires a strategic approach to ensure both financial stability and vehicle ownership. One key strategy is to prioritize consistent repayment according to the agreed-upon title loan payment schedules. This discipline not only helps borrowers avoid penalties but also demonstrates responsible borrowing practices, potentially improving future lending opportunities.

Additionally, keeping your vehicle is a significant aspect of successful title loan management. Borrowers should focus on making timely payments to maintain ownership and avoid repossession. Since these loans are secured against the vehicle, maintaining good repayment habits ensures you keep the car while still meeting financial obligations. This approach can be particularly beneficial for those relying on their vehicles for daily transportation or income generation, such as those with bad credit seeking quick cash solutions like Bad Credit Loans.

Title loan payment schedules have emerged as a significant consumer concern, with many individuals facing challenges related to their repayment terms. By understanding common pain points and implementing effective management strategies, borrowers can navigate these loans more successfully. This includes practicing transparent communication with lenders, seeking flexible repayment options, and educating oneself about the potential risks and benefits of title loan payment schedules. By adopting proactive measures, consumers can ensure they make informed decisions and maintain financial stability.